Unemployment tax calculator 2020

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. All employers must contribute that same rate into the UI fund.

How To Calculate Taxable Income H R Block

The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis.

. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. The federal law provides a gross income exclusion of up to 10200 per person for unemployment compensation reported on a 2020 federal income tax return for individuals under certain. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Generally states have a range of. It is mainly intended for residents of the US.

Once you submit your application we will. Refunds to start in May IR-2021-81 IRS reminds US. Each state also decides on an annual SUTA limit so that an.

You must pay federal unemployment tax based on employee wages or salaries. FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. This Estimator is integrated with a W-4 Form.

Unemployment income Tax calculator help Before we jump to your questions you may want to see how your unemployment income will affect your taxes. Kentuckys range for example is 03 to 9. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee.

Income tax rules relating to. The ranges are wide. For example if you are single with an adjusted gross income AGI of 70000 and you received 15000 of unemployment benefits during the 2020 tax year you would enter.

FUTA Tax Rates and Taxable Wage Base Limit for 2022. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The FUTA tax is 6 0060 on the first 7000 of income for each employee.

You can include your. Solved How to calculate FUTA Tax. The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019.

IR-2021-71 IRS to recalculate taxes on unemployment benefits. To calculate the amount of unemployment insurance tax. Territory residents about US.

This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. And is based on. At the federal level the taxable wage base is set at 7000 per employee.

How To Calculate Federal Unemployment Tax 2020. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Usually your business receives a tax credit of up to.

The tax rate is calculated on 9235 of your total self-employment income. But note that social security tax is applied on. The FUTA tax applies to the first 7000 of.

Establishing SUTA In calculating. Each state decides on its SUTA tax rate range. This is calculated by taking your total net farm income or loss and net business income or loss.

Most states send employers a new SUTA tax rate each year. Tax Calculator for 202021 Tax Year. By filling in the relevant information you can estimate how large a refund you have.

You may receive an updated SUTA tax rate within one year or a few years.

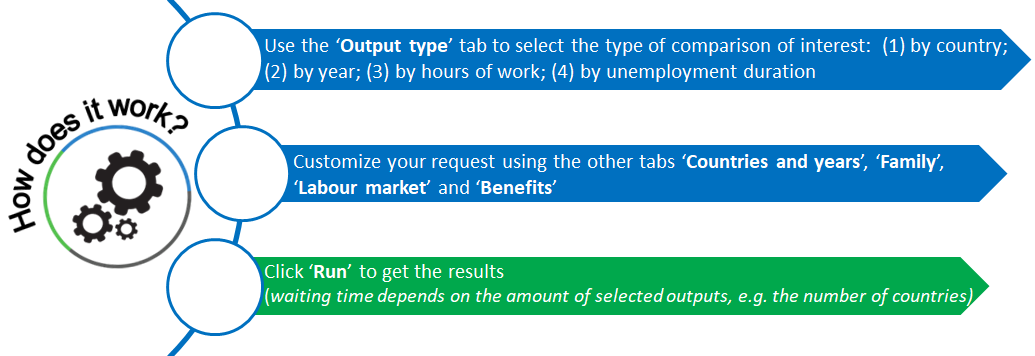

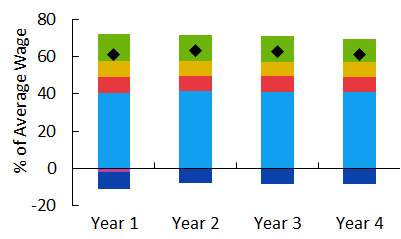

Tax Benefit Web Calculator Oecd

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Simple Tax Calculator For 2022 Cloudtax

Futa Tax Overview How It Works How To Calculate

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Benefit Web Calculator Oecd

Mathematics For Work And Everyday Life

How To Calculate Net Operating Loss A Step By Step Guide

Cerb Tax Calculator Cerb Tax Rate Kalfa Law

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Ontario Income Tax Calculator Wowa Ca

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Online Classes For Photography Businesses Mentorship

Traditional Investments Vs Airbnb Investments Infographic Investing Rental Property Investment Real Estate Infographic

Cerb Tax Calculator Cerb Tax Rate Kalfa Law